Legacy and Gift Planning

Make life better for children today, tomorrow and forever

Legacy and gift planning helps donors make an even bigger impact on Children's Health℠. These gifts are often arranged in advance to complement a donor's financial planning and can include any long-term or strategic donation. From including a short sentence in your will to creating an endowment that lasts in perpetuity, gift planning can help you make a difference for generations to come by creating a personal legacy to be proud of.

Explore the options below to discover the gift that works best for you, download our interactive booklet or request more information from our team. You can also reach us at ![]() GiftPlanning@childrens.com or call 214-456-8360.

GiftPlanning@childrens.com or call 214-456-8360.

If you have already included Children’s Medical Center Foundation in your plans, please complete this short form so we can plan for your gift and carry out your wishes.

Take action today

give stocks or securities

When you donate stocks or securities![]() , you make an outsized impact without taking money out of your bank account. Plus, neither you nor Children's Medical Center Foundation will be taxed on the gift or capital gains.

, you make an outsized impact without taking money out of your bank account. Plus, neither you nor Children's Medical Center Foundation will be taxed on the gift or capital gains.

donate cryptocurrency

Cryptocurrency donations are a new tax-efficient way to give. When you donate crypto![]() , you can deduct the fair market value on your tax return and avoid capital gains.

, you can deduct the fair market value on your tax return and avoid capital gains.

give from your retirement account

A qualified charitable distribution is a tax-efficient way for donors age 70½ or older to donate directly from an IRA![]() . These gifts can also count toward your required minimum distribution and bypass income tax implications.

. These gifts can also count toward your required minimum distribution and bypass income tax implications.

use a donor-advised fund

A donor-advised fund (DAF) is like a charitable savings account. You can contribute to the DAF as often as you like and earn immediate tax benefits, and later, you can recommend grants![]() to nonprofits on the timeline that works best for you. DAFs are also a great way to involve your family’s next generation of philanthropists.

to nonprofits on the timeline that works best for you. DAFs are also a great way to involve your family’s next generation of philanthropists.

Start planning for tomorrow

leave a gift in your will or trust

Creating a will can protect your loved ones while supporting the causes you care about. The gifts you set aside can be changed at any time and won’t affect your lifestyle today. To include Children’s Medical Center Foundation in your will or trust, you can meet with an attorney of your choice, borrow sample language from our website or use our free online tool at freewill.com/childrens![]() .

.

designate charitable beneficiaries

Adding Children’s Medical Center Foundation as a beneficiary on your bank account, retirement savings, donor-advised fund or life insurance policy is an easy and free way to support our mission. You can continue to use your accounts during your lifetime, and any remaining funds are distributed to the loved ones and/or charities you choose. To leave assets to Children's Medical Center Foundation, contact your financial institution.

donate a life insurance policy

When you transfer ownership of a life insurance policy to Children’s Medical Center Foundation, you or your estate may benefit from a charitable tax deduction. If you have a policy that has outlasted its original purpose or want to make a gift without affecting your cash flow, contact your life insurance provider. They can also help you name Children's as a beneficiary or obtain a new policy that supports our mission.

set up a gift that pays you income

A charitable gift annuity, a charitable remainder trust or a charitable lead trust can help you achieve financial security while making life better for children. Depending on the gift type, you can turn cash, stock, real estate and/or retirement assets into income while supporting Children’s Health. These gifts can also earn interest over time and/or provide additional loved ones with income, all while offering great tax benefits.

Make an impact that lasts forever

establish an endowment

You can create an endowment in your name, or in honor of someone you care about, with a donation of $50,000 or more. The endowment will support our mission in perpetuity, and if you choose, you can designate the funds for a specific area of need.

support a collective endowment

You can be part of something larger than yourself when you donate to a collective endowment. Collective endowments are funded by donors through gifts of all sizes, and you can choose to support clinical research, mental health or the general fund.

donate mineral interests

If you own interests that produce minerals or oil below the surface of a property, you can donate the royalties to benefit Children’s Health for years to come. In turn, you can benefit from an immediate tax deduction based on the fair market value and reduce your potential estate tax liability.

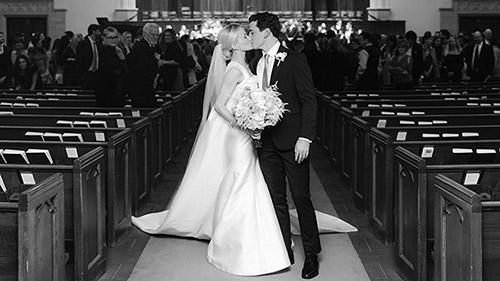

Join the Bradford Legacy Society

The Bradford Legacy Society honors donors who are paving the way forward through planned and endowed gifts. Members are invited to participate in exclusive educational and social events, as well as community engagement opportunities, to celebrate their unwavering commitment to our mission.

If you have been so generous as to include a planned gift for Children's Medical Center Foundation, please let us know so we can fulfill our duty to carry out your wishes.

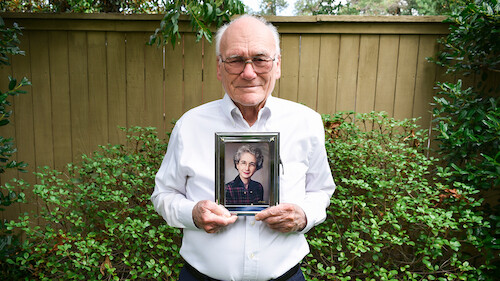

Our Donor Stories

Learn more about some of our remarkable donors who have made life better for children by making a legacy gift.

Resource library

Sample language for your will or trust

1. Leave a dollar amount

"I hereby give, devise and bequeath [dollar amount] to Children's Medical Center Foundation, a non-profit organization located at 2777 N. Stemmons Fwy., Suite 1700, Dallas, TX 75207, Federal Tax ID: 75-2062015, for Children's Medical Center Foundation's general use and purposes."

2. Leave a percentage

"I hereby give, devise and bequeath [percentage] to Children's Medical Center Foundation, a non-profit organization located at 2777 N. Stemmons Fwy., Suite 1700, Dallas, TX 75207, Federal Tax ID: 75-2062015, for Children's Medical Center Foundation's general use and purposes."

3. Give for a specific purpose

"I hereby give, devise and bequeath [dollar amount or percentage] to Children's Medical Center Foundation, a non-profit organization located at 2777 N. Stemmons Fwy., Suite 1700, Dallas, TX 75207, Federal Tax ID: 75-2062015, for [designated purpose]."*

*Please contact ![]() GiftPlanning@childrens.com to ensure we can accommodate your desired gift designation.

GiftPlanning@childrens.com to ensure we can accommodate your desired gift designation.

Legal name, address and tax identification

Legal name: Children’s Medical Center Foundation

Address: 2777 N. Stemmons Fwy., Suite 1700, Dallas, TX 75207

Federal tax identification number: 75-2062015

Wire/ACH/stock transfer instructions

Click here (pdf) to download instructions for making your gift. Please inform us before making the transfer by calling 214-456-8360 or emailing ![]() GiftPlanning@childrens.com.

GiftPlanning@childrens.com.

If actual stock certificates are being used, please mail the unsigned certificates by certified mail to:

Children’s Medical Center Foundation Attn: Legacy and Gift Planning 2777 N. Stemmons Fwy., Suite 1700 Dallas, Texas 75207

Each stock certificate must also have a signed stock power that should be mailed to the same address at the same time. Please mail the stock certificates and stock powers in separate envelopes.

If the stock is registered in more than one name, each person must sign the stock power form. Sign only your name(s) on the stock power form and sign exactly as your name appears on the stock certificate.

Please include a note with the stock certificates indicating the designation of your gift.

For advisors

Children’s Health hosts a network of dedicated advisors who are interested in making life better for children. Members of the Advisor Advocacy Alliance are mission-centric professionals from banking, wealth management, finance, tax, law, investment and other client-based industries. Learn more about our Advisor Advocacy Alliance and join today.

For assistance with arranging a gift on behalf of your client, contact ![]() GiftPlanning@childrens.com or call 214-456-8360.

GiftPlanning@childrens.com or call 214-456-8360.

Want to share your story?

Take our survey to tell us what is most meaningful to you about Children’s Health and our community, and how you’d like to make an impact on the future of our nonprofit organization.

Take Our SurveyContact us

To connect with a member of our Legacy and Gift Planning team, please email ![]() GiftPlanning@childrens.com or call 214-456-8360. You can also fill out this quick form linked below to request custom resources or download our interactive booklet to get started.

GiftPlanning@childrens.com or call 214-456-8360. You can also fill out this quick form linked below to request custom resources or download our interactive booklet to get started.