Charitable Remainder Trusts

Turn your appreciated assets into cash

A Charitable Remainder Trust (CRT) is a trust that can be funded with cash, real estate or stock to produce income for the lifetimes of you and a loved one. The funds are invested to grow with inflation and can be paid monthly, quarterly or annually, according to your preferences. At the end of the trust, Children’s Medical Center Foundation receives the remainder of the funds to make life better for children.

How it works

The asset is transferred into an irrevocable Charitable Remainder Trust.

If transferring property, the property is sold and the proceeds are invested in the trust.

We pay you and/or a loved one payments for life.

The remaining funds are distributed to Children's Health after your lifetime(s).

Benefits

Receive income for life for yourself and/or a loved one

Receive a charitable income tax deduction and avoid capital gains tax

If funding with real estate, step down from the role of landlord and leverage an alternative to a 1031 exchange

Make life better for children

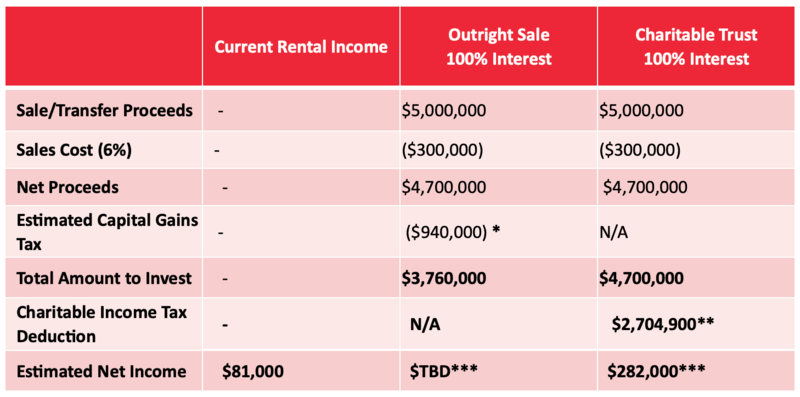

Example: CRT funded with real estate

Carl and Louise, ages 80 and 83, own an apartment building that produces an annual income of $81,000. They no longer wish to act as landlords but do not want to give up their consistent income stream. With an outright sale, they would incur significant capital gains taxes on the appreciation of the property. Instead, they choose to transfer the property into a Charitable Remainder Trust, sell the property and invest the proceeds in the trust. They receive a payments for their lifetimes that are higher than their current rental income. At the end of the term of the trust, the remainder goes directly to making life better for children at Children’s Health.

*Estimated blended Federal Long-Term Capital Gains Tax Rate of 20%, assumes an estimated cost basis of $0.

**Based on the donor ages of 83/80. This deduction can be used to offset other tax liability and can be carried forward for an additional five years.

***The estimated net income in the outright sale column depends on how the client decides to invest the net proceeds from the sale of the property. The net income from the Charitable Trust example reflects a 6% return based on its annual value.

These calculations are estimates and used for illustration purposes only and should not be considered legal, accounting, or other professional advice. Your actual benefits may vary depending on several factors, including the timing of your gift.

Legacy IRA Act

With the passing of SECURE Act 2.0, if you are over the age of 70 ½, you may now transfer a one-time tax free gift (amount adjusted annually for inflation) directly from your retirement account to Children’s Health to fund a Charitable Gift Annuity (CGA) or a Charitable Remainder Trust (CRT).

Our team is here to help

Our team of experts is here to help review the types of properties that may be well-suited for a CRT and work with our investment partners to turn your proceeds into a diversified portfolio.

If you have questions or would like to review a custom proposal, please reach out to ![]() GiftPlanning@childrens.com or 214-456-8360.

GiftPlanning@childrens.com or 214-456-8360.

Interested in learning more?

Reach out to our Legacy & Gift Planning team today to learn about ways to make a tax-smart gift.

Let us know

If you have been so generous as to already include Children’s Medical Center Foundation in your plans, please complete our recognition form to join our Bradford Society.