Investment Office

The Investment Office manages the financial assets of the hospital system, which include board-designated reserves in the form of a quasi-endowment, as well as donor funds entrusted to Children’s Health in perpetuity.

Our goal is to deliver outstanding long-term investment returns for the benefit of Children’s Health, our community, and our mission to “make life better for kids.”

About the Investment Office

The Investment Office was established in 2014 to manage the system’s financial assets in support of North Texas’s current and future pediatric care needs. The staff has grown to six full-time investment professionals who bring a wide range of institutional investment experience to the organization.

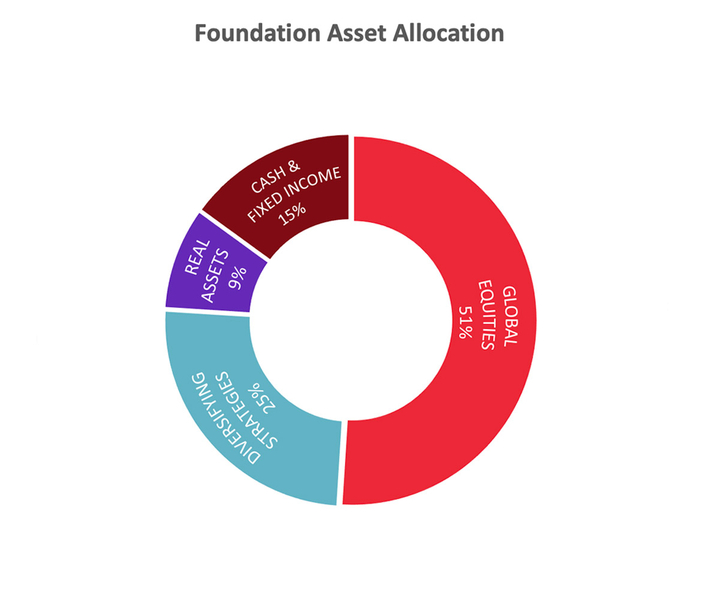

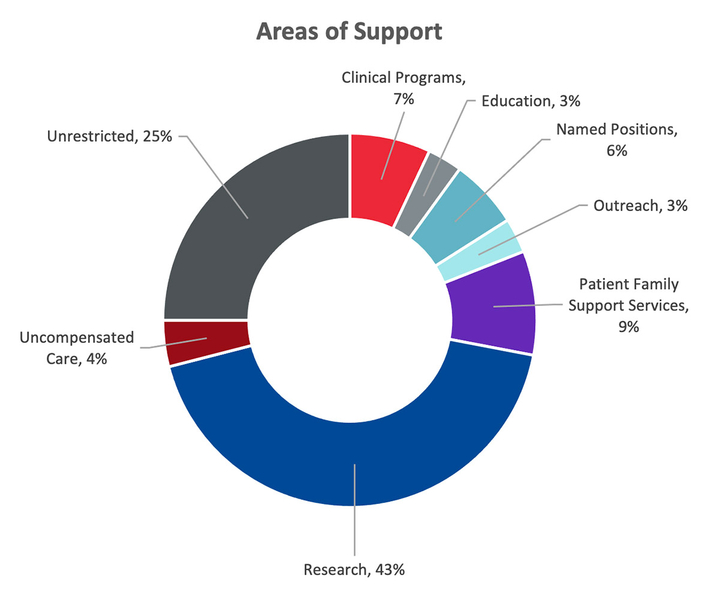

For the fiscal year ended 2023, the investable assets of the Children’s Medical Center Foundation totaled $2.1 billion dollars. Portfolio assets are used to support hospital operations and a variety of initiatives including capital expenditures for growth, medical research, and charity care.

System assets are invested to support consistent distributions to the hospital and its mission while preserving purchasing power over time. The investment portfolio maintains a balance capital appreciation potential, portfolio diversification, and risk mitigation in support of Children’s Health and its perpetual time horizon as a not-for-profit pediatric hospital in a growing region. Children’s Health is one of the few pediatric health systems in the United States to support an annual distribution substantially in excess of our minimum required payout.

Asset Allocation and Areas of Support

See more info in our recent Endowment Prospectuses:

What is the investment philosophy at Children’s Health?

The Foundation’s investment portfolio offers a wide array of opportunities for active investment management, giving us the chance to partner with talented external fund managers to identify investment opportunities with expected returns exceeding that of the broader stock and bond markets.

Our investment philosophy revolves around four distinct pillars: a long-term investment horizon, focus on active management, deliberate portfolio diversification, and prudent risk management. Portfolio diversification across investment mandates, styles, geographies, and asset classes combined with our focus on active management provides us with the opportunity to seek out long-term investment outperformance for the benefit of Children’s Health.

The Investment Office’s primary fiduciary duty is to the financial interests of the hospital system, its mission, and our community. Because of the perpetual nature of our mandate, we prioritize partnerships and investment strategies that can generate sustainable long-term returns to support the Children’s Health mission for generations to come.

What we look for in investment partners

We are always eager to meet talented investment partners that can grow with us as we look to realize our goal of making life better for children. If you are interested in partnering with us or supporting our mission, please contact us at ![]() investmentinfo@childrens.com.

investmentinfo@childrens.com.

Investment Staff

Kyle Stewart

Sr. Director of Investments

Kyle Stewart joined the Investment Office in 2020 and serves as a Director of Investments. Kyle focuses on the foundation’s marketable investments including diversifying strategies, fixed income and liquid real assets.

Prior to joining Children’s Health, Kyle was a senior investment professional at Irvington Capital and previously held roles at CTC myCFO, Taylor Investment Advisors and Bank of America Merrill Lynch.

Kyle holds a B.B.A. from Texas Tech University’s Rawls College of Business and a M.S. in Finance from Southern Methodist University’s Cox School of Business.

Yangge Seaman

Sr. Director of Investments

Yangge Seaman joined the Investment Office in 2021 and serves as a Director of Investments, leading investment activities for private equity, venture capital, private oil & gas, and private real estate strategies.

Prior to joining Children’s Health, Yangge was a senior investment professional at ICMA-RC and Texas Children’s Hospital. Yangge started her career at UNC Management Company.

Yangge holds a B.B.A. from the University of Notre Dame and is a CFA Charterholder.

Chris Andry

Sr. Director of Investment Ops & Risk

Chris Andry joined the Investment Office in 2022 and serves as Director of Investment Operations Director. In this capacity, Chris manages operational workflows, fund flows, risk management, and reporting on the foundation's portfolio investments.

Prior to joining Children's, Chris spent 15 years in the hedge fund industry working with Dallas-based hedge fund HBK Capital Management in portfolio finance, treasury management, and reporting.

Chris holds a B.B.A. from Texas Tech University’s Rawls College of Business and is pursuing an MBA from Baylor University’s Hankamer School of Business.

Cory Garcia

Investment Director

Cory Garcia joined the Investment Office in 2022 and serves as a Portfolio Manager. Cory focuses on the foundation’s marketable investments including public equities, fixed income and liquid real assets.

Prior to joining Children’s Health, Cory held various investment research roles at Invesco/OppenheimerFunds, Raymond James & Associates and PricewaterhouseCoopers.

Cory holds a B.S. in finance and accounting from Trinity University.

Jonathan Goetsch

Investment Associate Portfolio Manager

Jonathan joined the Investment Office in 2022 and serves as an Investment Associate. Jonathan focuses on the foundation’s private investments, including leveraged buyout, venture capital, private oil & gas, private real estate, and private credit strategies.

Prior to joining Children’s Health, Jonathan served as an investment professional at GuideStone, where he spent 11 years and led investment activities across private real assets, including real estate, infrastructure, and natural resources.

Jonathan graduated from Dallas Baptist University where he earned a Bachelor of Science in Music Business. He earned his MBA from the University of Texas at Arlington. Jonathan is also a CFA Charterholder.