Charitable Gift Annuities

Receive income today and make life better for children tomorrow

If you are over the age of 65, a Charitable Gift Annuity (CGA) is a great way to make life better for children while creating a lifetime of financial security. This life-income gift is made with a one-time donation to Children's Medical Center Foundation in exchange for monthly, quarterly or annual payments back to you and/or a loved one. At the end of the annuity, all remaining funds from the invested gift will support Children's Health.

How it works

You transfer cash or appreciated assets to Children's Medical Center Foundation.

The Foundation invests the funds.

We pay you and/or a loved one fixed payments for life based on a rate determined by your age(s).

The remaining funds are distributed to Children's Health after your lifetime(s) to make an even bigger impact.

Benefits of a Charitable Gift Annuity

Receive fixed payments to you and/or a loved one for your lifetime(s)

Benefit from consistent monthly, quarterly or annual payments

Delay income taxes and/or capital gains taxes

Make life better for children

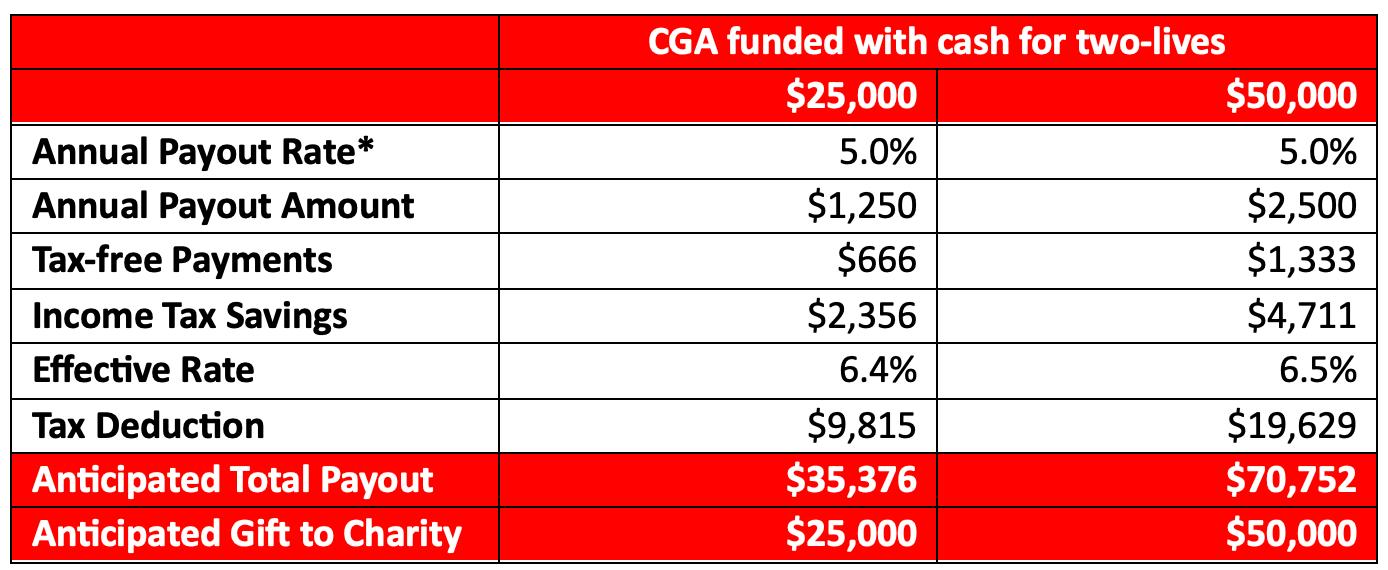

Example: CGA funded with cash for two lives*

*January 2024 rates based on ages 71 and 65. Details will vary depending on your age(s) and the date of the gift. CGAs can be funded with cash, appreciated securities (stocks, bonds, mutual funds), personal property and, starting at age 70½, certain types of retirement accounts like IRAs.

Legacy IRA Act

With the passing of SECURE Act 2.0, if you are over the age of 70 ½, you may now transfer a one-time tax free gift (amount adjusted annually for inflation) directly from your retirement account to Children’s Health to fund a Charitable Gift Annuity (CGA) or a Charitable Remainder Trust (CRT).

Our team is here to help

If you have questions or would like to review a custom proposal, please reach out to ![]() GiftPlanning@childrens.com or 214-456-8360.

GiftPlanning@childrens.com or 214-456-8360.

Interested in learning more?

Reach out to our Legacy & Gift Planning team today to learn about ways to make a tax-smart gift.

Let us know

If you have been so generous as to already include Children’s Medical Center Foundation in your plans, please complete our recognition form to join our Bradford Society.