What is a Donor-Advised Fund (DAF) and how does it work?

A donor-advised fund, or DAF, is a charitable investment account that allows donors to set money aside to make charitable contributions over time and receive an immediate tax deduction. DAFs are a popular type of planned giving that allows donors to contribute as often as they’d like and recommend distributions to qualified charities, like Children’s Health℠, whenever it is best for them.

How do Donor-Advised Funds work?

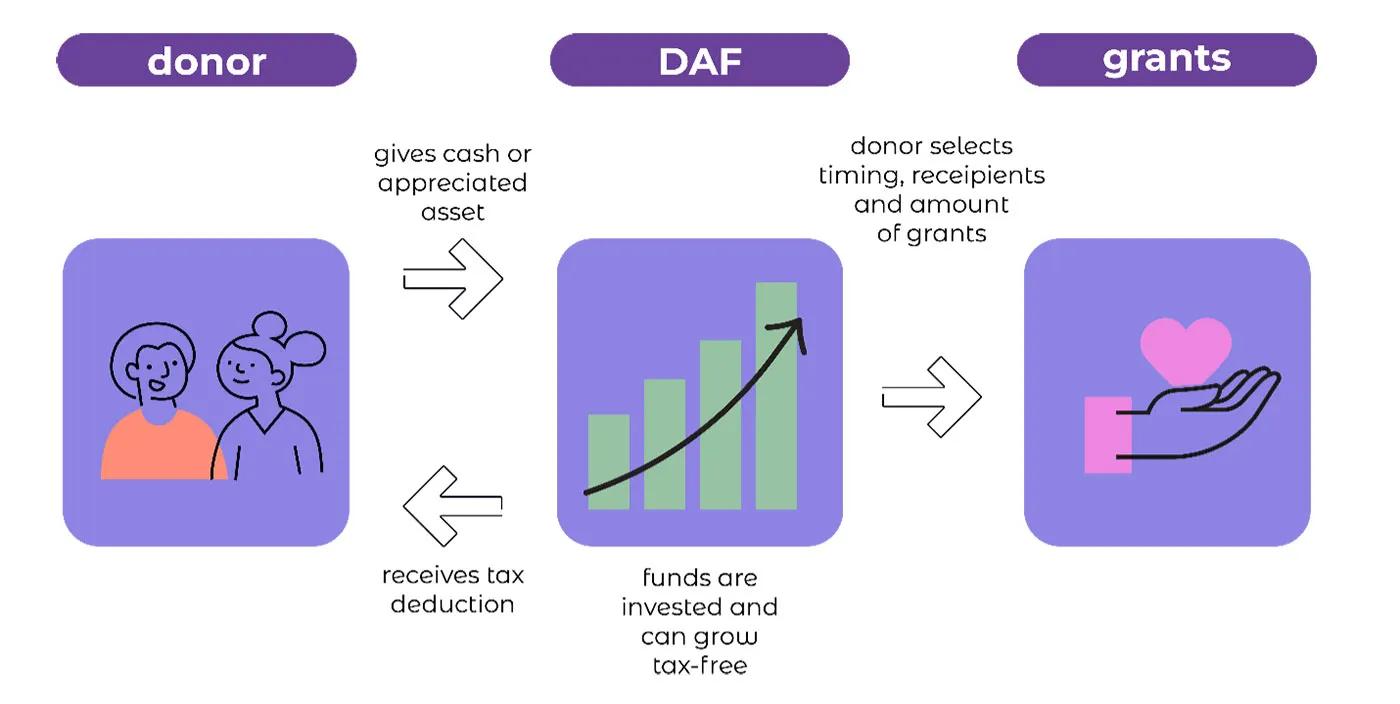

A donor-advised fund (DAF) works by allowing donors to contribute cash and other appreciated assets like real estate, stocks and fine art to a donor-advised fund account.

Here’s what happens next:

Investment and Growth

The assets in the DAF may be invested, and any investment growth is tax-free for the donor.

Grant Recommendations

When you’re ready, log into your DAF account and recommend grants to support qualified nonprofits.

Children’s Medical Center Foundation is one of the many eligible organizations you can support, or you can use the IRS search tool

to find other qualified charities.

to find other qualified charities.

What are the advantages of a Donor-Advised Fund?

DAFs allow donors to give when, what, how and where is most favorable for them. Benefits of donor-advised funds include:

Tax Benefit

Receive a tax deduction for each contribution to the DAF reduces taxable income for the year of the donation (up to 60% of your adjusted gross income).

Eliminate capital gains tax on long-term appreciated assets (assets held for more than one year)

Flexibility

DAFs provide flexibility by allowing donors to contribute funds at any time and decide later how and when to distribute grants.

Because they separate the timing of a tax deduction from when grants are distributed, donors can contribute to grants when they want.

Legacy

Simplify the administration of your charitable giving before and after death.

What is the difference between a DAF and a private foundation?

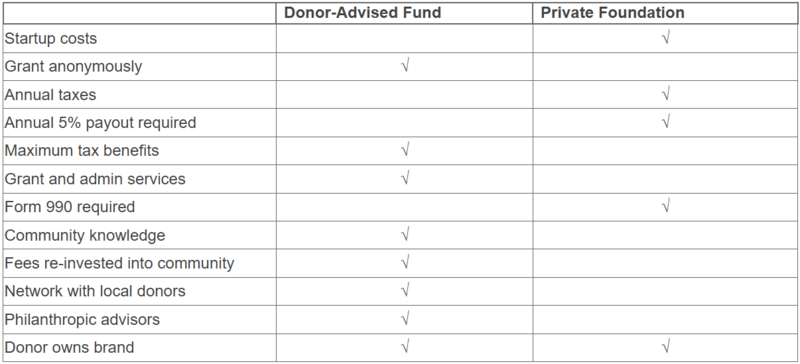

Donor-Advised Funds (DAFs) and private foundations are both charitable vehicles used for investing and distributing grants, but they differ significantly in structure, oversight, and operational requirements. DAFs offer the benefits of a private foundation, such as tax-deductible contributions and the ability to recommend grants, without the complexity, administrative burden or additional expenses.

A private foundation is typically a standalone legal entity with its own board of directors and stricter regulatory requirements, including mandatory annual distributions and detailed IRS reporting.

DAFs are managed by sponsoring organizations which handle administrative tasks and legal compliance, allowing donors to focus on grantmaking.

This distinction makes DAFs a more accessible and cost-effective option for individuals seeking to engage in philanthropy without the operational demands of running a private foundation.

To designate a DAF grant to Children’s Health, provide the following to your DAF sponsoring organization:

To recommend a donation from a DAF, you need to provide the Children’s Health legal name, address and Employer Identification Number (EIN).

Legal Name: Children’s Medical Center Foundation

Address: P.O. Box 847253, Dallas, TX 75284-7253

Employer Identification Number: 75-2062015

Donor-Advised Fund FAQs

What is a DAF?

DAF stands for donor-advised fund. A DAF is a giving vehicle that provides an immediate tax benefit to a donor and allows them to grant funds to nonprofits of their choice.

How does a donor-advised fund work?

A donor makes an irrevocable contribution to a donor-advised fund and receives a tax deduction for the year the gift is made. Once the gift is made, the sponsoring organization has legal control over the funds and the donor can make grant recommendations to nonprofits of their choice when the donor chooses to do so.

Are there any rules to owning a donor-advised fund?

Yes, there are donor-advised fund rules. The IRS has specific guidelines around the types of organizations that are eligible to receive grants as well as the purposes the grants can serve. For instance, grants can only be made to qualified nonprofits and not to a person, or the donor cannot receive more than an incidental benefit, so it cannot be used for the admission price for an event or a gala. Distributing funds from a DAF to Children’s Health is a great way to make life better for children today.

Who owns the money in a donor-advised fund?

In a DAF, the money is legally owned by the sponsoring organization that manages the fund. Once a donor contributes to a DAF, they relinquish legal ownership and control of the assets, receiving a tax deduction for the donation at that time.

The donor does retain advisory privileges, meaning they can recommend how the funds are invested and which qualified charities should receive grants from the DAF. These recommendations are non-binding, and the sponsoring organization has the final authority over distributions to ensure compliance with IRS regulations.

Is there a tax deduction for donor-advised funds?

Yes, there is a donor-advised fund tax deduction. The DAF donor will receive tax documentation from the sponsoring organization of the DAF.

What is the typical size of a donor-advised fund?

In the U.S., the size of individual DAFs varies significantly. The average size of a DAF was estimated to be $159,000 in 2020.

Can I establish a DAF directly with Children's Medical Center Foundation?

While we do not establish DAFs, the DAF you create with any sponsoring organization can be used to support the mission of Children’s Health through grant distributions to make life better for children.

How popular are donor-advised funds?

DAFs have become more popular in recent years. In 2020, contributions to and from DAFs rose in the U.S. The number of individual DAFs rose above 1 million and the amount that DAFs granted represented a 27% increase over 2019, marking it as the highest DAF increase in a decade.

What happens to a donor-advised fund when you die?

When you die, a Donor-Advised Fund (DAF) continues your charitable legacy with a successor advisor. When you create your DAF, you would appoint a successor (family, friend, professional) who would manage the fund and recommend grants after you’re gone. Your successor would follow your pre-planned instructions in your will or DAF agreement, ensuring your giving continues seamlessly and often removes assets from your taxable estate.

Can you pull money out of a donor-advised fund?

Generally, no you cannot pull money out of a donor-advised fund for personal use because once funds are donated, they are irrevocable and legally belong to the sponsoring charity. You can recommend that qualified charities use the funds for specific charitable purposes, like scholarships, or even transfer the balance to another DAF or a private foundation.

What are the disadvantages of DAFs?

Donor-Advised Funds are popular charitable giving vehicles, but they do come with some drawbacks.

Loss of Control and Irrevocability: Once assets are donated to a DAF, they are permanently given away and cannot be returned.

No Payout Requirements: DAFs are not legally required to distribute funds to charities on any specific timeline. This can lead to the money sitting idle rather than being used for charitable purposes.

Restrictions on Gifts: DAFs cannot be used to pay for items that provide a personal benefit to the donor, such as gala tickets, auction items or tuition.

Fees and costs: depending on the sponsoring organization, they could charge administrative and investment fees, which could range from 0.60% to 1.5%

Kids count on us. We count on you.

Give to support innovative research, lifesaving treatments and compassionate care.

Did you enjoy this story?

If you would like to receive an email when new stories like this one are posted to our website, please complete the form below. We won't share your information, and you can unsubscribe any time.